Not all insurance coverage service providers provide SR-22 filings. An SR-22 may be needed for 3 years for sentence of driving without insurance or driving with a put on hold certificate and also up to five years for a DRUNK DRIVING.

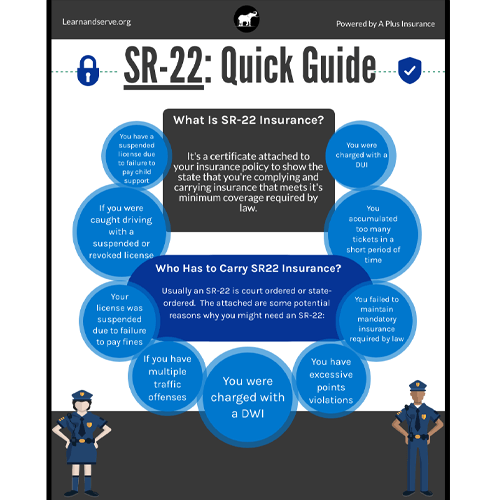

Some, but not all, states require you to get an SR-22 if your driver's certificate has been revoked or put on hold as well as you want to drive again. You may need to have an SR-22 on declare one to 5 years, relying on the state. What Is SR-22 'Insurance'? An SR-22 is a document that reveals evidence of monetary obligation in situation you're involved in an automobile mishap. sr22.

insurance sr22 department of motor vehicles sr22 coverage insurance companies

insurance sr22 department of motor vehicles sr22 coverage insurance companies

Who Needs an SR-22 Certificate? The regulations for when an SR-22 is needed differ by state, and also not all states require vehicle drivers to have one. In Texas, as an example, motorists are required to submit an SR-22 with the state department of insurance if their certificate was suspended as a result of a car collision, they've obtained a second or succeeding conviction for not having obligation insurance coverage, or a civil judgment has been submitted versus them - insurance companies.

Again, not everybody requires an SR-22. Yet normally, you may be needed to have one if you: Are captured driving without a permit or insurance policy, Have a driving drunk (DUI) or driving while intoxicated (DWI) conviction, Have a certificate put on hold due to excessive crashes or relocating infractions, Owe exceptional court-ordered kid assistance payments, Incur numerous repeat driving offenses quickly structure, Are getting a hardship or probationary driving license Bear in mind that you might be needed to have an SR-22 on file in the state you're accredited in also if you live and drive in another state - auto insurance.

Important If you permit your SR-22 certificate to gap, your motorist's permit can be suspended. Some states call for insurance companies to alert them when an SR-22 lapses or is terminated. The length of time Do You Required an SR-22 Certificate? The size of time you need to keep an SR-22 certification will additionally rely on your state's requirements.

Not known Incorrect Statements About Sr22 Insurance In Minnesota Explained - Policy Advice

Washington state splits the distinction and establishes its need at three years. If you need an SR-22, it's important to understand when the clock begins ticking.

If you're purchasing a brand-new automobile insurance coverage, you may be able to conserve money by shopping around. Tell the insurer upfront that you require an SR-22, just to make sure the company provides them. When you have an SR-22 certificate, the insurance provider will certainly file it with the state on your part.

High-risk automobile insurance in Ohio will certainly not be inexpensive, as premiums for risky plans in the state average $1,648 per year. That's around 46% greater than the average expense of vehicle insurance coverage in Ohio generally. Nonetheless, high-risk drivers in Ohio should still have the ability to find ideal auto insurance coverage alternatives after window shopping. vehicle insurance.

For this reason, many insurance policy firms won't also sell coverage to risky motorists. Various other insurance providers specialize in risky protection, so vehicle drivers with a checkered record have choices. The most effective high-risk vehicle insurer in Ohio are State Ranch, Progressive, Nationwide since they are monetarily solid and also have couple of customer issues.

sr-22 insurance credit score sr22 insurance group sr22 coverage

sr-22 insurance credit score sr22 insurance group sr22 coverage

In the end, the demand for risky cars and truck insurance is a momentary scenario. Significant offenses like DUIs are on your record for life in Ohio, yet a lot of offenses fall off your record within three to 5 years. department of motor vehicles.

Sr22 Insurance Filing - Fundamentals Explained

Lots of people might not know much regarding SR22 insurance coverage. Possibly you know a person who required it at one factor in their lives. Or, perhaps you are that person? We are going to try to improve a couple of concerns concerning this problem. SR22 is a file generated by an insurance policy company and also submitted with DMV confirming that a chauffeur has appropriate vehicle liability insurance coverage. division of motor vehicles.

Motorists who have actually had their licenses suspended or revoked due to auto mishaps, speeding, or driving while intoxicated are generally the ones required to comply. The insurer will certainly also Additional hints keep the state updated on your cars and truck insurance coverage renewals as well as cancellations. The state typically requires this declare a few years to see to it you are keeping your insurance policy in excellent standing constantly (auto insurance).

The most regular factors are: If you have been captured driving without a valid insurance coverage If you are captured driving under the impact or while intoxicated If you are caught driving without a certificate or with an ended one If you have also several tickets in the short time structure If you prefer on-line acquisitions, you can obtain your insurance coverage using the Web, or you can get in touch with an insurance policy firm as well as fulfill with the representative.

That can be complicated because charges differ from state to state. Not every insurance coverage business uses SR22 insurance policy.

An SR22 exists to cover home damages as well as any liability developing from a crash in which the covered chauffeur is entailed. vehicle insurance. It is taken into consideration a "economic obligation" insurance policy because it covers the motorist's liability to others who may be associated with an accident. It will not, in all instances, cover the fixing or substitute value of the proprietor's auto or that of the other car included in the mishap.

What Does Sr22 Insurance - What You Need To Know - David Pope Mean?

bureau of motor vehicles driver's license sr-22 insurance insurance auto insurance

bureau of motor vehicles driver's license sr-22 insurance insurance auto insurance

If you are trying to find the ideal rates for SR22 insurance coverage in California, call our professionals at Breathe Easy Insurance coverage today. division of motor vehicles.

Which Ohio Insurance Companies Deal the Cheapest SR-22 Insurance Policy? SR-22 insurance coverage in Ohio costs even more than a normal cars and truck insurance policy, largely due to the intensity of linked website traffic infractions.

To get affordable SR-22 insurance coverage in Ohio, you'll need to select from a number of alternatives. The most economical business for SR-22 car insurance in the state is USAA, with a typical expense of $357, followed by State Ranch at $379. Scroll for more Show more, Compare Automobile Insurance Rates, Ensure you're getting the very best price for your automobile insurance coverage.

sr22 auto insurance department of motor vehicles insurance group driver's license

sr22 auto insurance department of motor vehicles insurance group driver's license

If you need to acquire SR-22 insurance coverage as well as are searching for sensible rates, you need to assess quotes from a minimum of 3 companies. Protecting SR-22 insurance policy in Ohio comes with an expense (insurance group). Risky motorists will need to pay an one-time charge of about $25 to get their types submitted with the state.

sr-22 insurance dui auto insurance car insurance bureau of motor vehicles

sr-22 insurance dui auto insurance car insurance bureau of motor vehicles

The price of SR-22 insurance differs based on the type of infraction. What Is SR-22 Insurance Policy in Ohio? Individuals commonly call it SR-22 insurance, SR-22 is not an insurance policy strategy however a type finished by your insurance policy service provider to proves that you meet the minimal responsibility protection needs of your state.

The Definitive Guide for Sr22 Insurance

While trying to find insurance policy protection in Ohio after a ticket or crash, you'll locate that those prices are substantially less than those of drivers that require to get SR-22 insurance. Just how long you ought to have SR-22 insurance coverage in Ohio depends upon the seriousness of your offense - dui. A lot of offenses just require you to have it for three years, serious ones like a hit-and-run may call for more time.